There is no secret that SEO audits are a must for every business that wants to succeed in the ever-changing online environment and that they are the first step in the development of any digital marketing plan. We all want to know as much as possible from the niche we are competing in, whether we are well established businesses or a small company that wants to expand into new markets. How many visitors does my website attract? Why do my competitors attract so many more? These are some of the questions that constantly pop up into any digital marketer’s mind.

The truth is that the more you can find out about your business and your competitors, the more you can learn, adapt and ultimately flourish.

And this kind of information can be gathered from an in-depth analysis like the one we are going to tell you about in the following lines. A comprehensive organic niche study that includes but is not limited to a uber professional backlink audit.

You can use this kind of analysis whether you want to develop or improve a link building strategy, analyze the competition and have a clear view where the competition stands or identify your competitive advantages and your flaws alike.

As a methodology, in our analysis we took into consideration three in-depth “sub-analyses”, each of it being an important part of our organic market analysis puzzle:

- The SEO Visibility Audit

- The Link Audit

- The Content Audit

What’s an Organic Market Analysis?

The organic market analysis focuses on the impact of organic search in a very specific market (it can be industry-bound, geographically-bound, or a combination of the two).

This in-depth approach can yield quite a variety of useful tactics. You can:

- identify missed opportunities

- find your (or your competitors’) weaknesses

- spot new strategies and fill in the ranking gaps

- get an in depth understanding of your competitors’ strategies

- get a better grasp on the dynamic of your organic position in relation to your competitors.

That’s why we’ve decided to put under the magnifying glass the tire market in the UK as we’ve spotted some particularities we can all learn from.

The UK Online Tire Market – Comprehensive SEO Audit

The market we’re looking at? The tire market in the UK. It sounds like a very specific and narrow market with not much going on, but there’s plenty to look at. An Industry Factbook from 2011 reports that over 300 brands of tires are available for purchase in the UK, sourced from over 45 countries around the world. Approximately 15 million tires are produced in the UK every year for vehicles ranging from motorbikes and cars to trucks and even aircrafts – although, according to another report, 80 per cent of the total tire demand in the country is passenger car oriented.

Tire manufacturers, however, only account for 20% of UK tire retailers. UK wholesalers/distributors make up for an astounding 75% of the market, while European wholesalers only account for 5% of the market. The retail sector itself looks pretty crowded, with national and regional chains, local players, vehicle franchise dealers, national vehicle servicing chains and independent garages all competing for a spot in the profit race.

A tough, but rewarding market, considering that the total retail sales of replacement tires amount to about £3.2 billion per year.

As far as the role the Internet plays in all of this, the report highlights that although it is a growth area, the penetration of Internet traders remains small, at a meager 3%. Still, given the considerable revenues and the growth of everything Internet-related, it makes for a very interesting analysis.

Step 1: The SEO Visibility Audit

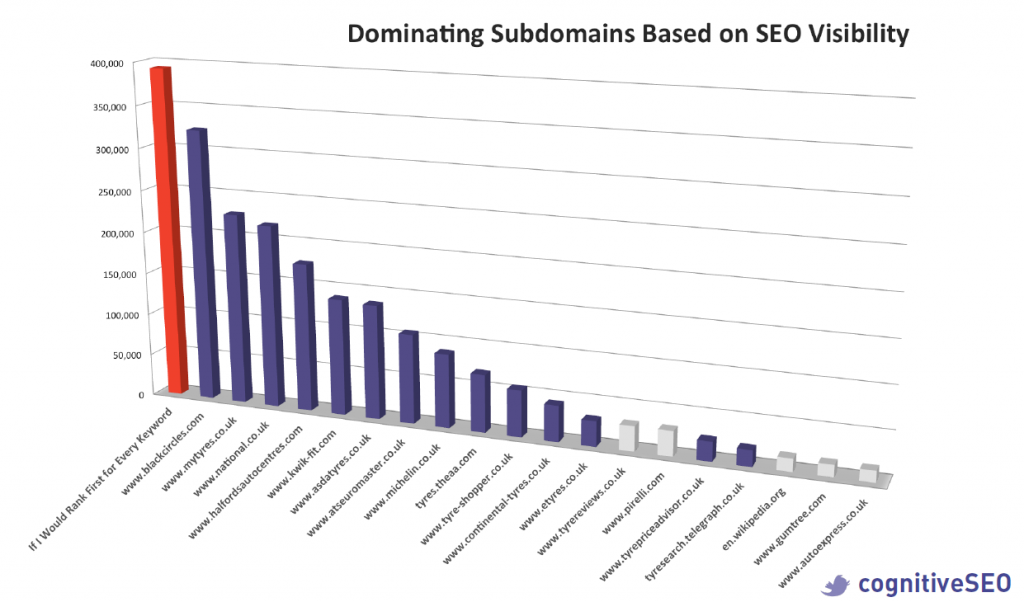

In order to evaluate the visibility of the main players (and see who they actually are), we started with a list of the 1 000 most used words to search for tires. The keywords list was made through research, mixing long tail and short tail keywords.

How do people search for tires (to buy)?

What searches ultimately got them to tire-selling websites?

We used mainly Google Keyword Planner and Excel in order to make keywords combinations.

We managed to gather the data through large scale localized top 10 SERP extractions, using our Rank Tracking API from where we extracted the positions and volume of the keywords. It’s important to mention that for our analysis we’ve included keywords containing the word “tyre” with an “y” as this is the version used and searched for in UK. As the saying goes, when in Rome, do as the Romans do. Once we compiled the list, it was time to run our 3-step SEO Visibility Analysis.

First, we calculated every Keyword’s Weight as the Volume of that keyword (the average number of searches per month as reported by Google) multiplied by the Ranking Position Weight.

We defined the Ranking Weight in relation to the Position of a website in the search list for a keyword (so Position 1 got Weight 1, Position 2 got Weight 0.9, Position 3 got Weight 0.8 and so on).

This actually yielded quite a large amount of data, which started to make sense when we organized it by the SEO Visibility. This meant we summed up the Keyword Weights separately for each subdomain. When all was said and done, we picked out the Top Players, meaning the top 20 subdomains ranked by SEO Visibility (out of a total of 1 087 subdomains that ranked for at least one word).

It turned out that the findings of the report translated well enough into our findings, with the top 7 positions being taken by retailers and the first tire manufacturer only coming in at number 8: Michelin. The next manufacturer, Continental, barely misses the top 10 by one spot, while Pirelli lags off at 14. This peaked our interest and we wanted to take a closer look at the online plight of the tire manufacturer in the UK.

The red bar from the chart represents the highest possible rank that a website could have.

If, for instance, there had been such a site that would have ranked first for every keyword tracked in this analysis, then, that would have been it’s SEO visibility score. As we can see in the chart above, blackcircles.com is somehow the nearest from this ideal position, yet a bit far away from the monopoly position.

It turns out there’s more to it than breaking the top 10 in the organic search visibility ranks.

We’ve excluded from the analysis the companies that you see marked in grey color in the chart above. And this is not because we don’t like those websites but because they don’t match the UK tire niche. Pirelli, for instance, has the .co.uk version but doesn’t even make the cut in top 20. We’ve also excluded Wikipedia page and also some websites that don’t directly produce or sell tires but are more sort of product comparators.

Step 2: The Uber Backlink Audit

SEO isn’t just about visibility in organic searches, it’s also about who’s who and who knows – and recommends – you.

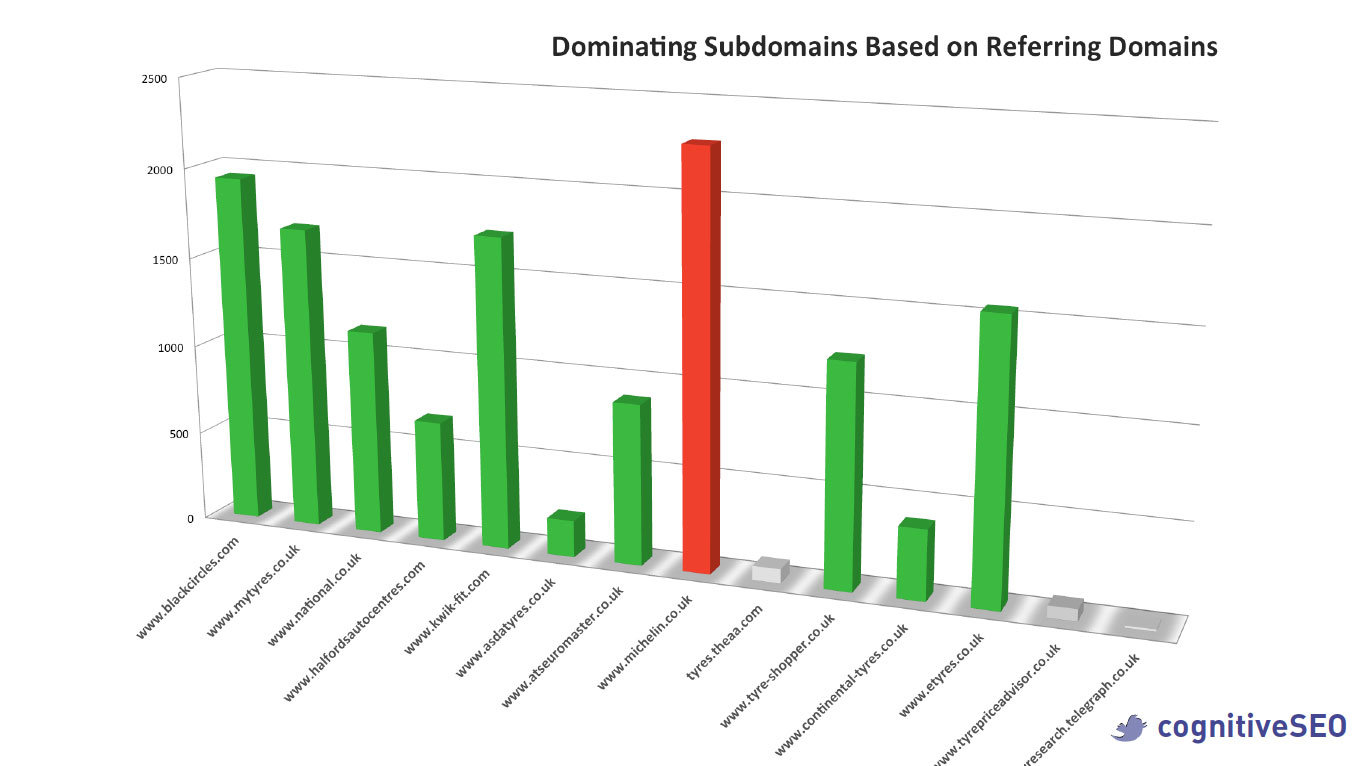

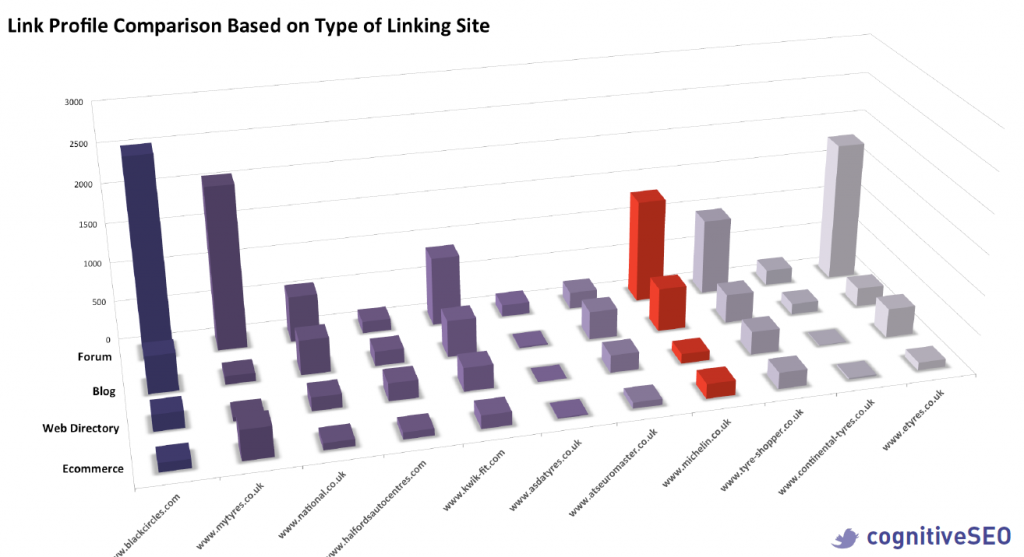

We ran a link audit on the top 20 to see how the SEO Visibility correlates to links.

It doesn’t, at a first sight. Sure, the top 3 contenders from before (Black Circles, My Tire and National) all have a decent score, but Michelin is the undisputed leader by a large margin. It’s not a manufacturing thing either, as Continental barely rakes in enough referring domains to show up in the top ranks.

Our findings regarding Michelin and its impressive number of referring domains made us curious, therefore we decided to take a closer look and, if it’s the case, to draw some lessons.

More than 120 years ago, 2 brothers, Edouard and Andre Michelin began being extremely enthusiastic about the pneumatic tire after they’ve failed repairing a bicycle tire. One century later, their enthusiasm was translated into a business with a €21.47 billion revenue, according to their site. Yet, as we are in the digital marketing niche, we couldn’t stop wondering how much did the SEO strategy contribute to this success and whether there is still room for improvements when it comes to the third largest tire manufacturer in the world.

Michelin is one of the main tire manufacturers in the UK, but as we’ve seen from the statistics, being a manufacturer doesn’t automatically guarantee you top of mind when it comes to direct sales.

In fact, a lot of people don’t necessarily intend to buy a certain tire brand (unlike a certain brand of car). What they do intend to buy are “cheap tyres”, or “motorcycle tyres” or “Rolls Royce tyres” (yes, we know that don’t all British people own Rolls Royces) If those phrases sound familiar, it’s because that’s what somebody would look for on a search engine if they wanted to buy new tires for their vehicle. This was precisely our starting point, as we began our analysis with a visibility analysis for the top players on the market.

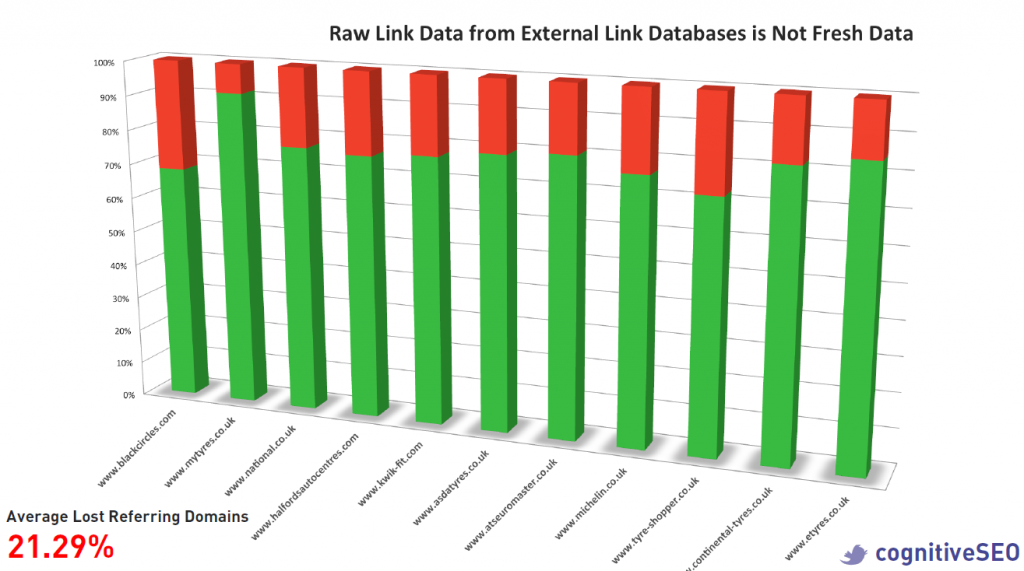

In every backlink audit, the first and maybe the most important step is the “link gathering”.

On-demand link crawling from as many link sources as possible is of highly importance as this is the point of foundation for any conclusion that we might further draw.

The conclusions of any research form any field of study cannot be valid if the raw data are incomplete, inaccurate or flawed.

Of course, raw data is not necessarily fresh data so we ran an on-demand crawl to see the live/lost referring domains ratio for each of the top ranking website. It turns out that Michelin isn’t necessarily special in that aspect, as it ranks pretty close to the average of lost referring domains (21.29%). But even when taking this into account, Michelin still tops the competitors in the referring links game.

So where does the high SEO Visibility come from in this Market? What powers it?

It’s not really sheer number power. Sure, the numbers are good, but they’re top 5 good, not number 1 good. Black Cirlces, My Tyres and even eTyres have higher numbers when it comes down to it. And the distribution in terms of type of linking site is roughly the same:

- forums have the lion’s share

- then it’s usually blogs while

- web directories and e-commerce sites usually amount for the smallest percentage.

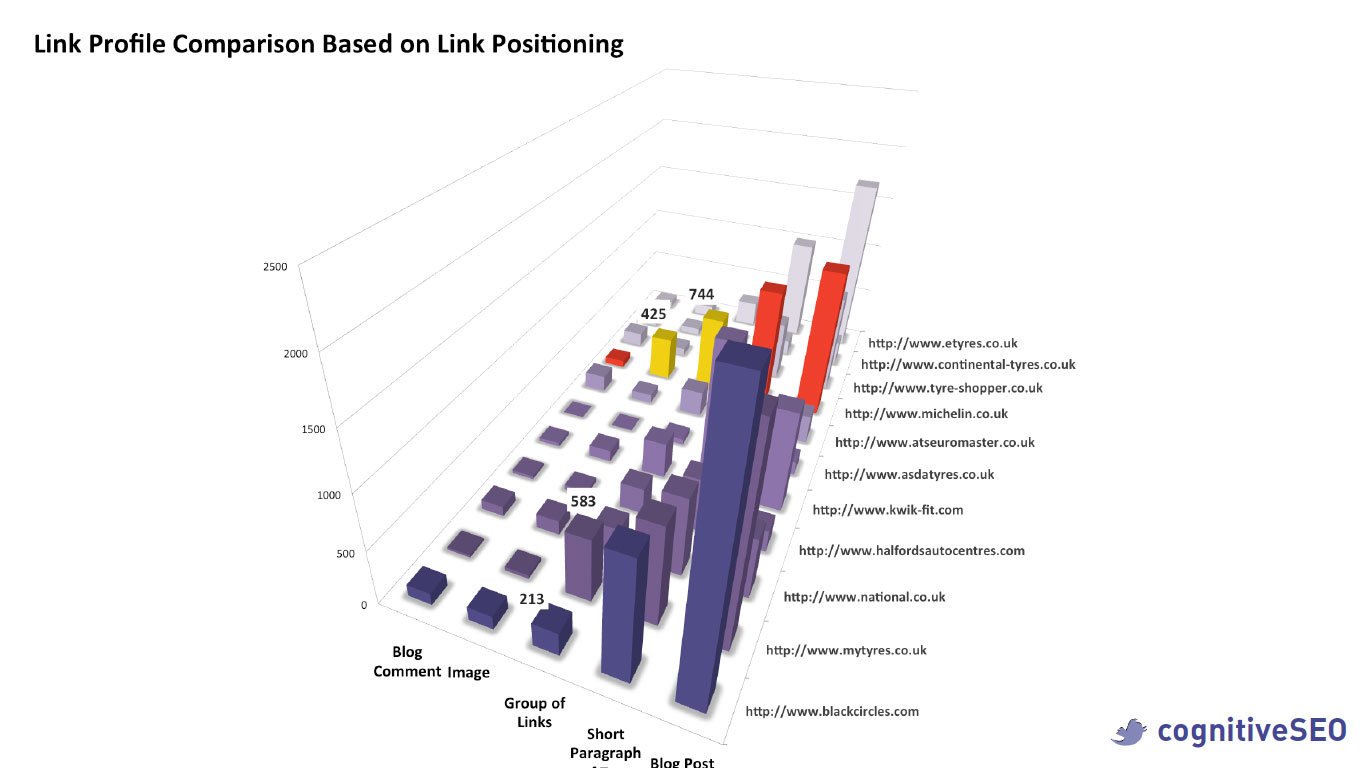

There is something special about Michelin though, if we look at the link profile comparison based on link positioning.

Everybody’s got a lot of links in blog posts and in short paragraphs of text. And everybody’s got very few links in blog comments.

But everybody’s also got very few links attached to images – except for Michelin.

In that particular area they are undisputed leaders.

They also have the upper hand when it comes to presence in a group of links. Only My Tyres comes close, but a clear second, while the others are clearly far behind. Wouldn’t that usually be indicative of something wrong though?

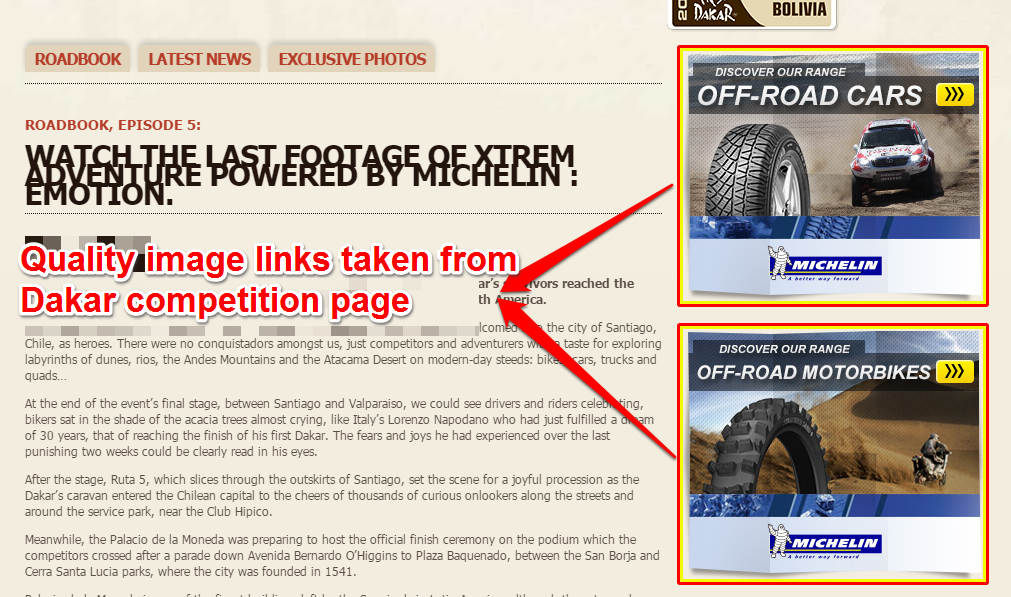

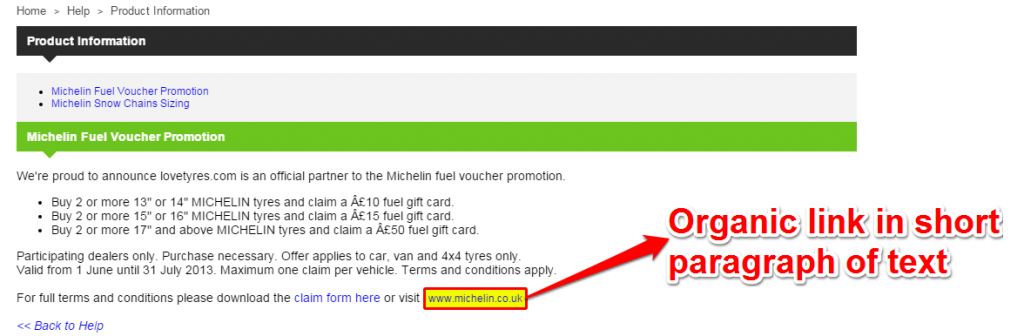

Below you can see some screenshots taken directly from cognitiveSEO’s Link Navigator, where it can be seen that even if links are in images or in short paragraphs of text, unlike the usual expectancy, they are organic, quality links. This is the case, for instance,for the image link from the screenshot below, taken from the prestigious Dakar Rally Raid. Also, a lot of organic links can be found in short paragraphs of text, context that usually is not the most “Google friendly”.

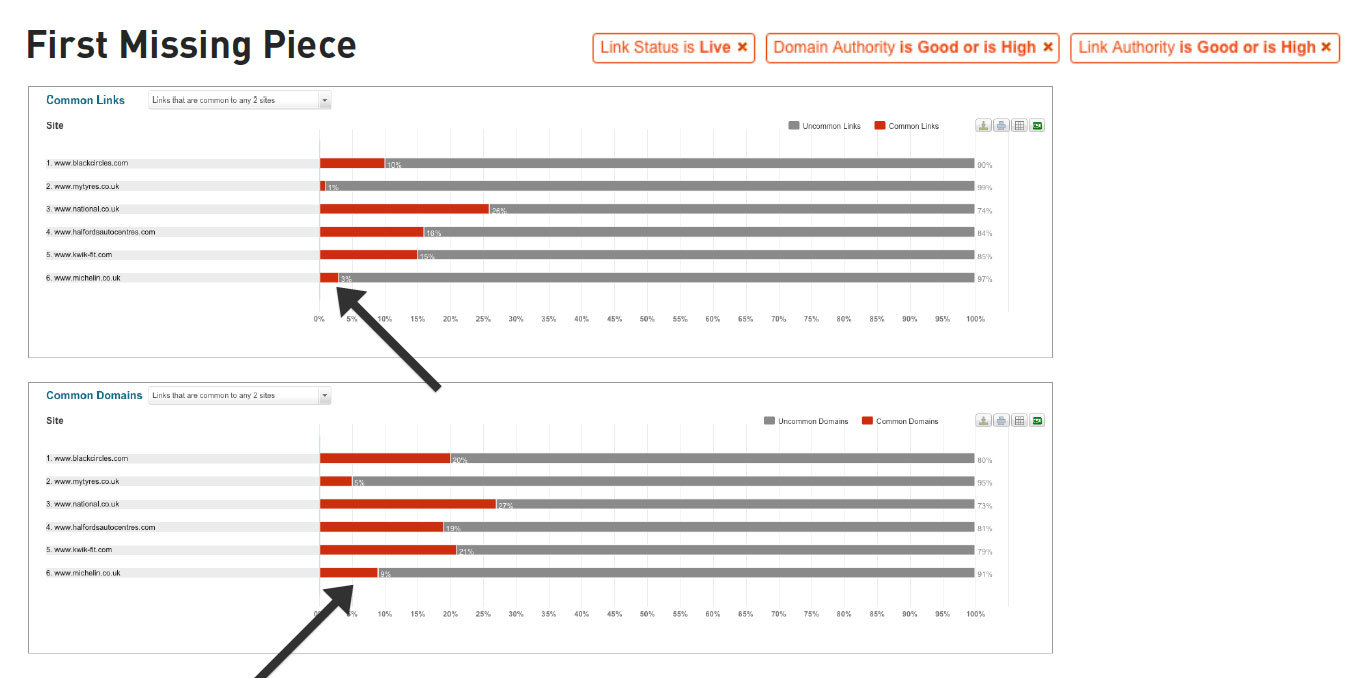

First Missing Piece of the Link Puzzle

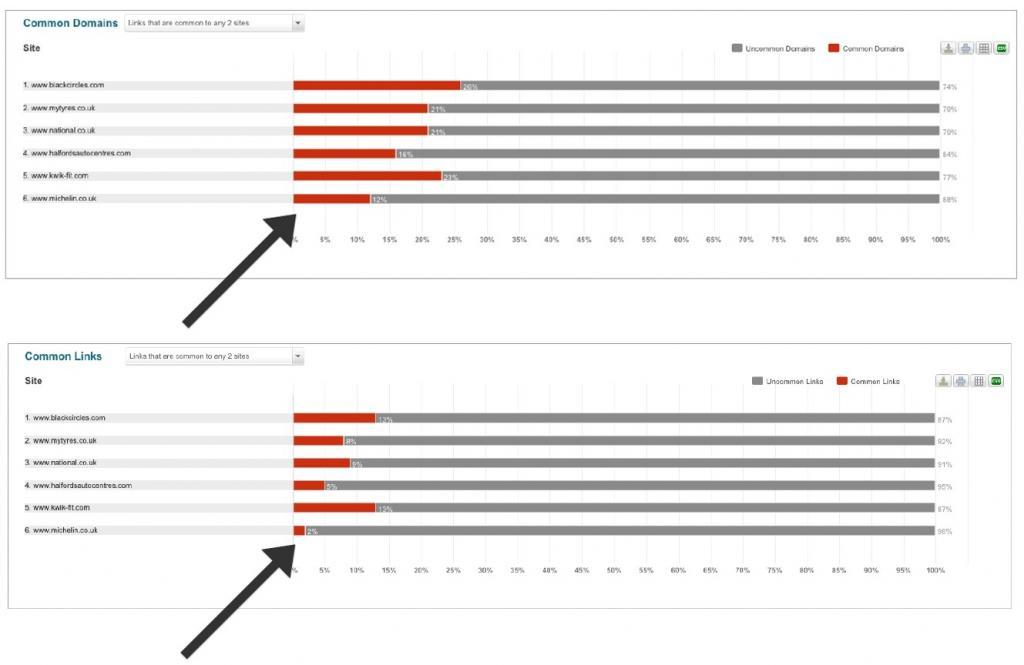

Michelin is anything but usual, actually. Not just metaphorically. They have very litlle in common with their online competitors and that’s what makes them tick.

Their common links ratio stops at an impressive 2%. Black Circles, for comparison, goes all the way up to 13%.

This uniqueness is maintained even when we look at domains. Michelin shares only 12% of its referring domains with its competitors.

The communality score for Black Circles? More than double, at 26%.

Even when filtering results for live links with good or high authority coming from domains with good or high authority, Michelin still comes at the top, only behind My Tyres. But while Michelin doesn’t come too much behind My Tyres, the rest of the competition trails off significantly behind Michelin.

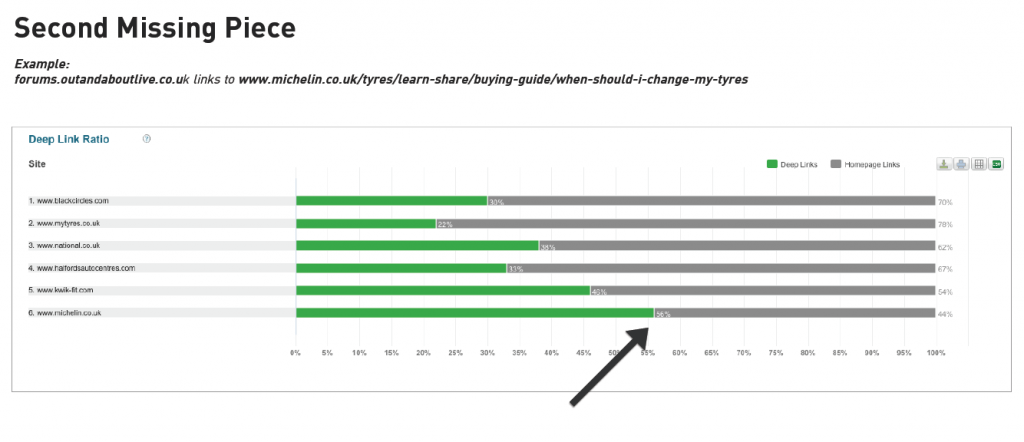

Second Missing Piece of the Link Puzzle

There’s also a second missing piece to the puzzle and it’s highlighted by the Deep Links analysis. It turns out Michelin has a higher percentage of deep links than any of the first top 5 sites. This means that when other domains link to them, they don’t just link to their homepage (that, as it turns out, happens less than 50% of the time), but they link to a specific section on Michelin’s website. This, indirectly, is also indicative of high quality links and higher overall authority: spammy links are much more likely to be directed to the homepage of a website, while specific links are much more likely to be tied to actual content on the referring domain.

So they have the uniqueness advantage going for them, but this analysis also proved that their links come from good (and even high) authority links and domains.

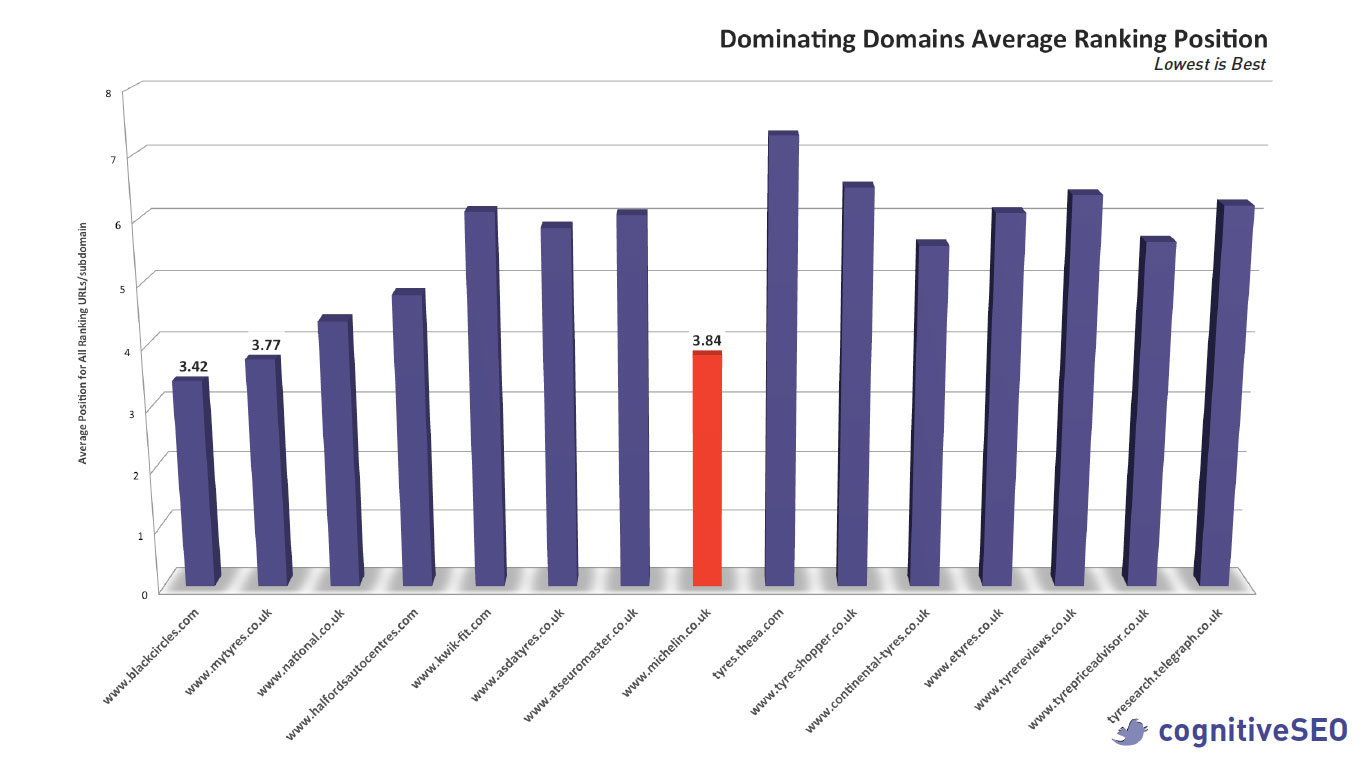

That might also explain their performance in the average ranking position, where they came in 3rd, with a score of 3.84, only after Black Circles (3.42) and My Tyres (3.77).

It means that on average, that’s where they would go for the 1 000 keywords. It doesn’t necessarily mean that they would consistently rank 3rd and 4th for every word, but it can mean that they rank 1st and 2nd enough times to balance out the times they rank much lower.

Unlike any other competitor, the homepage/ deep link ratio is in favor for the second category.

And it seems that there is a connection between the deep links ratio and high average ranking ratio.

Links like the one you see in the screenshots below are the deep links that bring added value to Michelin in terms of ranking. Not only are they deep links, but they are highly contextualized and seem to be highly helpful for the user.

Step 3: The Content Sharing Audit

More often than not, people are not completely aware of how much content they have. And if they are aware, they don’t always know how effective it is. And how do you know where you’re heading to if you don’t know where you are?

A content audit is an important piece when doing a Digital Marketing Analysis as it uncovers content patterns to inspire future strategies. Useless to say that it uncovers your competitors’ content marketing strategy as well.

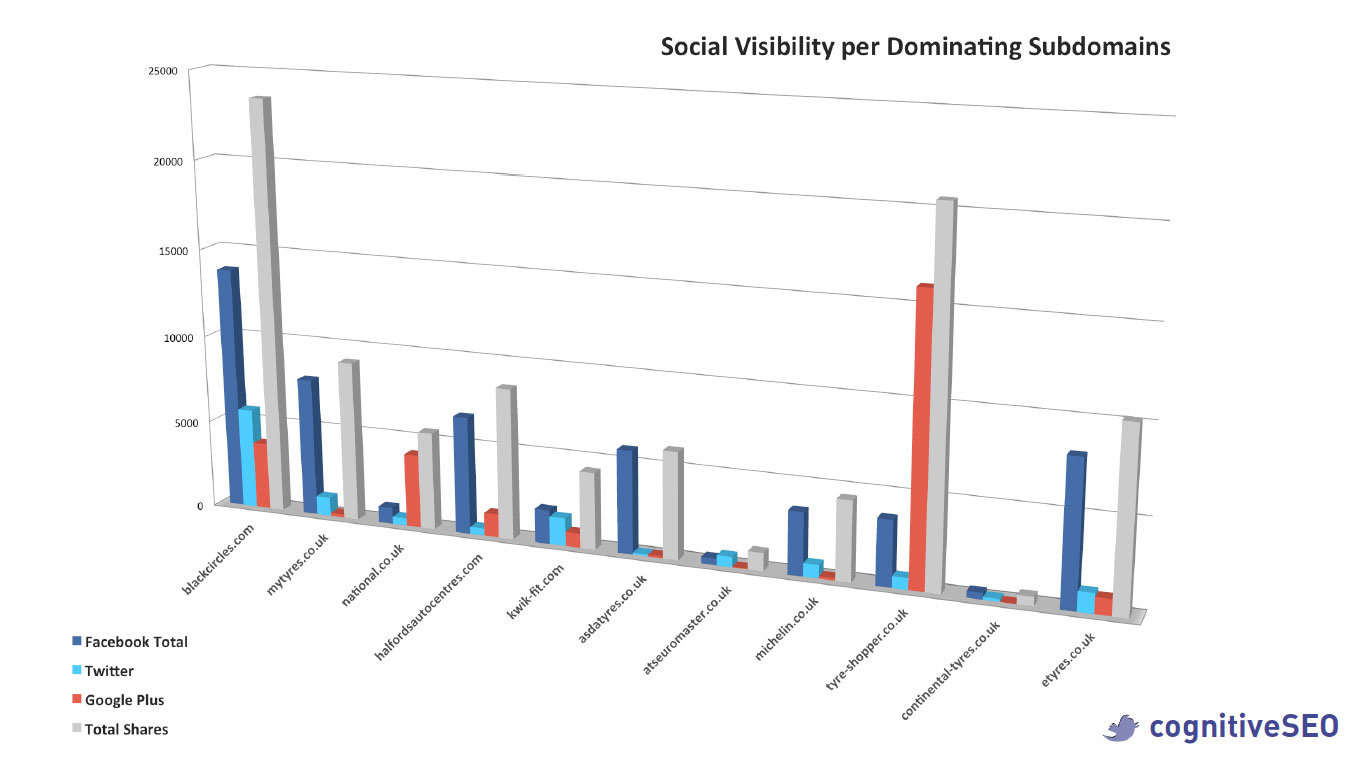

And, as content relevance is not just about what is said, but where it’s said and to whom, what about Social Shares? Social Media presence is on the rise and it’s constantly touted as the next thing in marketing, though it generally might not be. And indeed the tire niche is not the ground of fertile social media marketing. While the top retailer has the top social media presence (except for Google Plus), the rest of the scores are not really conclusive, as you can see in the chart below.

This content audit was made possible thanks to our new content visibility module that helped us to easily extract the number of shares that each competitor has on all major social networks but it also correlated those numbers with the SEO Visibility so that we have a clear overview on the social and content visibility of each subdomain vs its rankings in Google.

What we wanted to see was whether there is any good reason to believe social networking sites have any relation to page ranking beyond anecdotal evidence.

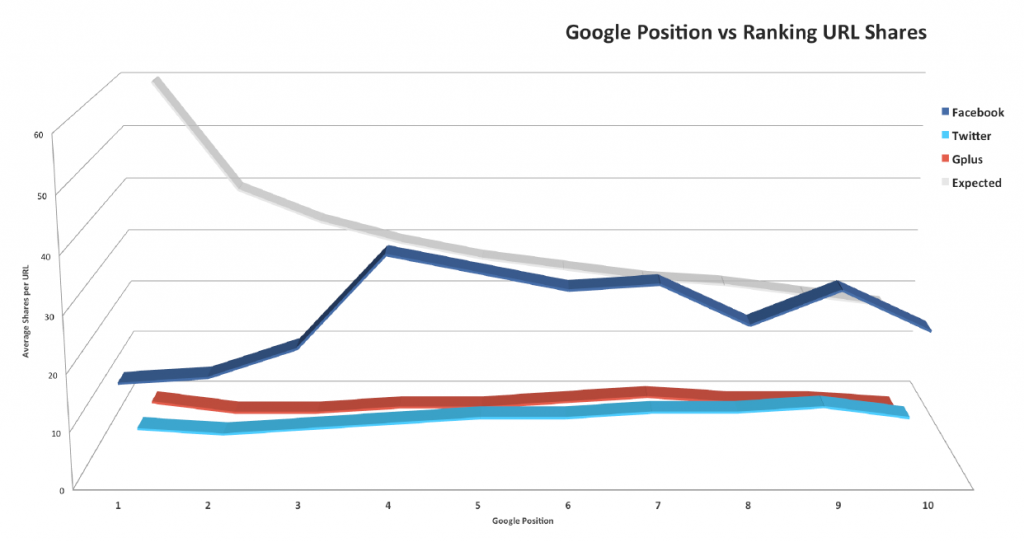

We extracted the number of shares in relation to position for all the keywords. In order for us to test a correlation between the two elements, we had to break down the data. We couldn’t just look at averages of shares and plot them against positions, or else we would miss out on more subtle things that happen inside the averages. We’ve removed all the highs and lows and, when plotting Google Position vs Ranking URL Shares.

It turns out there’s no linear relationship between social media shares and overall search engine ranking, unlike you would expect.

There is no direct effect between the number of shares and the rankings. We won’t say that there is no correlation between the two of them, but as statistics teach us, correlation does not imply causation meaning that a correlation between two variables does not necessarily imply that one causes the other.

Tire Niche Fingerprint

There are a lot of things that you can find out about the tire niche. There are things that come out after some online research, just like the ones presented to you at the beginning of the article when we’ve talked about the UK online tire market. But there are also some other things, invisible to the eye at the first glance but revealed to thorough a uber audit like the one we’ve done. After compiling some reports and data, we found out that approximately 15 million tires are produced in the UK every year. And that is great info. Yet, we needed such an in-depth market audit to find la “crème de la crème”.

There is more to the tire niche than meets the eye.

This analysis could also be named “How to outsmart your competitor by doing a better link audit”.

And this is possible due to all the findings extracted from the current analysis, a great piece of competitive intelligence for the tire niche. He who holds the information holds the power, goes the saying. And without the information, no matter how good you are in the digital marketing area, you cannot put together a strategy that will pay off. The correlation between deep linking and rankings, the power of common/uncommon domains or how to “fingerprint” a link profile based on its many particularities – these are all pieces of information that we wouldn’t have had access to if we hadn’t run this organic niche audit.

Can Michelin Make Any Improvements?

As we take a look at the whole Michelin strategy, is not hard to tell that they are doing pretty well. Yet, as the saying goes, there is always room for improvement and that is the biggest room in the house. What could Michelin do in order to have even better rankings and SEO visibility? We don’t assert that we have the success recipe, yet we thing that the following pieces of advice would make a difference.

1. Michelin could invest some time in link prospecting on high quality common links and domains from competitors.

As we’ve talked about above, Michelin has just a few links and domains in common with its main competitors. What Michelin could do is take a big advantage of the link intersect chart presented above. They could compile a list of domains and links that are interested in their line of business, investigate each of them, take note on how they may acquire that link or how they can make an appearance on their website and start an outreach campaign. Websites that are already linking to Michelin competitor’s businesses will have a higher chance of having their business displayed on their website since it’s in their audience’s interest.

2. They could create campaigns to attract high quality organic homepage links.

We’ve seen that they are doing very well in terms of deep link ratio and that is great; yet, having good, trustworthy links directly to their homepage might be a bit difficult to achieve, yet, it will surely pay off in terms of ranking and sales.

3. Michelin can easily overtake competitors due to current link diversification.

We’ve explained above how they stand out from all competitors by having a varied link profile. Yet, what the tire manufacturer should do is to be constantly aware of where their links are coming from and always keep an eye on diversification. Even if they’re focusing on quality links from several sources, they’ll likely encounter the issue of an unbalanced link profile. Unlike their competitors, having links in images or in group of links can be in their advantage. They just need to take more advantage of this benefit.

Market Intelligence that Moves the Needle

We are aware of the fact that just a few of you are into the tire market. Yet, this type of analysis is just an example of how a niche analysis should be done and the benefits it could bring. Just think of all the findings that we extracted for the tire niche and imagine that this type of conclusions can be drawn for any niche.

All you need to have is interest in the field, a bit of time and of course, the right tools.

Instead of Michelin, the review could have focused on any other site from any other niche.

For instance, for this analysis to be carried through we needed about 10 hours and one person to do it. ( 2 hours of link and SERP crawling and 8 hours to analyze the data)

The good part is that the crawling for all the sites, all the charts, graphs, data and every piece of information in terms of all the analyzed site took less than two hours ( this includes the keyword research, rank tracking extraction, the backlink audit, the SEO Visibility calculation and the content visibility extraction).

The other 8 hours were spent on “reading the data” , interpretating and drawing conclusions. We don’t want to imagine how many weeks this research would have taken if we hadn’t have the tool to help us out here.

And even if we would had dedicated weeks to a research like this, we still wouldn’t have had access to this kind of visualization that has helped us to understand what’s really going on in this market.

But don’t forget that the most important “tool” is you, the person doing the audit! Having a trained mind and using the correct set of tools puts on your radar the biggest and most interesting pitches in your professional career.

This analysis was first presented at BrightonSEO, a one of the biggest search marketing conferences in UK. You can check out the whole presentation from the conference right here:

Site Explorer

Site Explorer Keyword tool

Keyword tool Google Algorithm Changes

Google Algorithm Changes

This is a very interesting analysis with some really nice research. However, it needs to be asked, because the subject did not come up anywhere that I could see, were you researching the correct data? In the US, it is spelled ‘tire’ but in in the UK, we spell it ‘tyre’.

yes. good question. the research was done using the correct spelling for the UK. “tyre”. When starting the research I noticed the difference and focused on the UK version of the keywords. It makes a big difference.