We’ve seen and heard many people just throwing their business online, many times with great products, and failed at it. One of the reasons they failed was a lack of a well-structured marketing plan before they started the journey and as well as of competitive intelligence data. In today’s article, we wish to address that issue by presenting the tools made available by Google and going through some concepts and ideas that can be extracted with their use.

Let’s talk about the free tools from Google made available for you, tools that cost nothing and can offer you enough information to gain a sense of the market you’re about to jump into, besides a handful of actions and strategies you could perform to skyrocket your business. A true jam – packed with value!

- Arsenal of Tools

- Your Market’s Behavior

- Uncovering Your Competitors’ Secrets

- Identify New Market Opportunities

1. Arsenal of Tools

First things first, the weapons you have at your disposal. We’re sure you know that Google offers a wide variety of tools, all free of charge (we’ll repeat that today), that help you gather information about the market and, more importantly, competitors information. So we have the following: Google Keyword Planner, Google Trends, Ad Preview and Diagnosis tool, Google My Business, Google + and last but not least Google Analytics.

The Free Google Tools can be used to study your current competitors and also your site or generic niche.

All the tools mentioned above can be used to benchmark your own website, but you can also use them to keep track, measure and research any other site you desire. Google doesn’t limit their use in any shape or form, so why not use them to get ahead of your market?

1.1 Google AdWords Keyword Planner

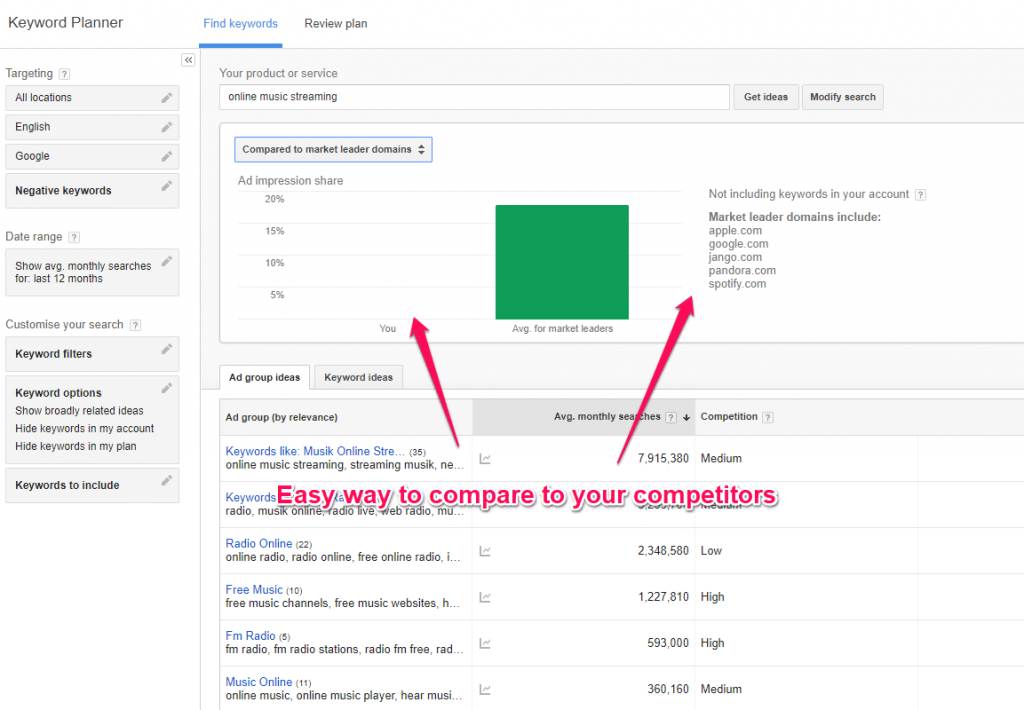

The first weapon in the arsenal is the Google AdWords Keyword Planner. Now it’s not what it used to be. We miss you “Google keyword tool”! But it does bring a lot of value to the table, in terms of performing keyword research, finding the cost and so on. You can get some pretty good suggestions. Take a look at the screenshot below.

The tool has a free format and a paid option. All users that have an active Adwords campaign will see more accurate data, and those who use the free option will see restricted info.

If you want some juicy competitive information, consumer search behavior, then you can use this free Google tool. It shows what people are searching for, how they are searching for it, and where they are searching for it: languages, dates, volumes of searches as well as the bidding competition that’s going on in Google Adwords.

All of this by simply entering the keywords of the business you’re interested in. The next step, the pros practice, is to filter all that noise that comes with the tool, and we believe that’s what most people are complaining about this tool, the noise. What’s left after the advanced filtering action are the keywords that you want for your business. Especially the keywords with a high search volume, low competition with really low bidding war going on. We’ll get into that later on, let’s move on to the next weapon.

1.2 Google Trends

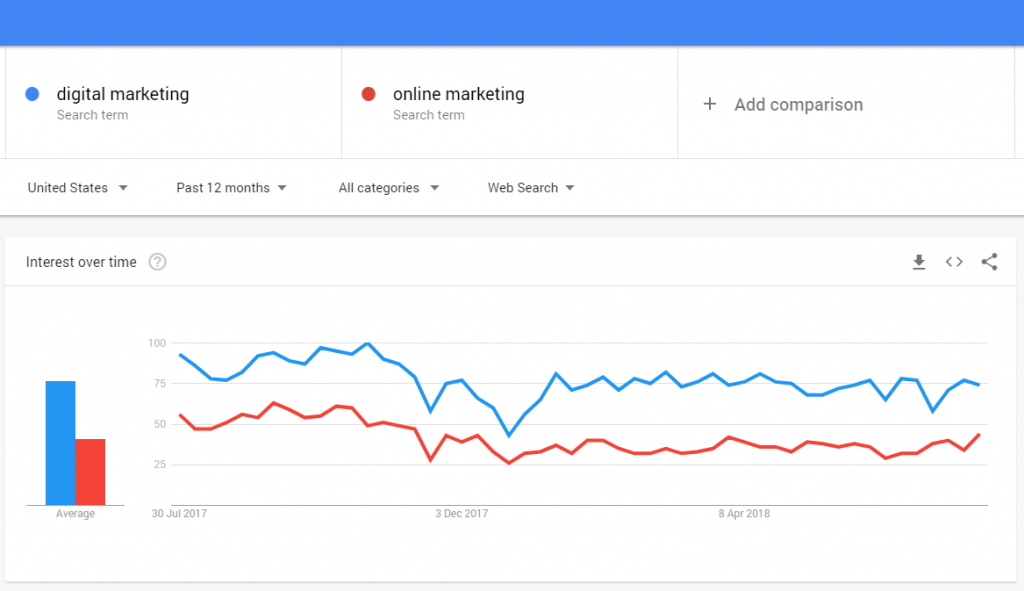

Another great tool for marketers to make competitive research is Google Trends. This one is by far our favorite tool when studying markets. It basically shows the search interest of people for certain keywords. What you should use it for is to study the market you want to tackle.

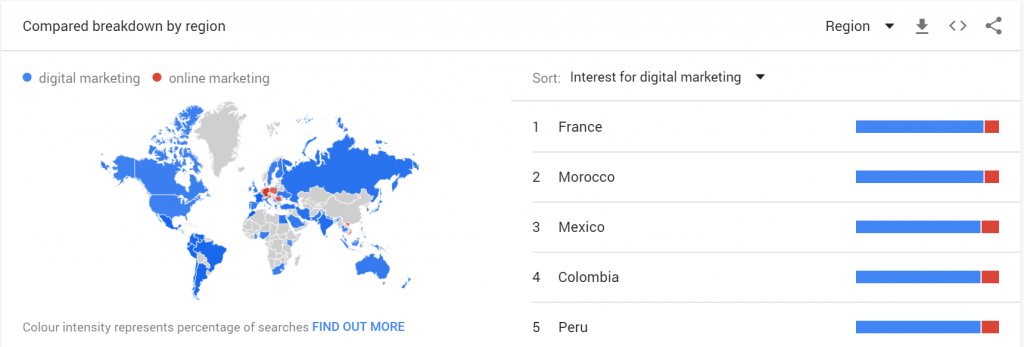

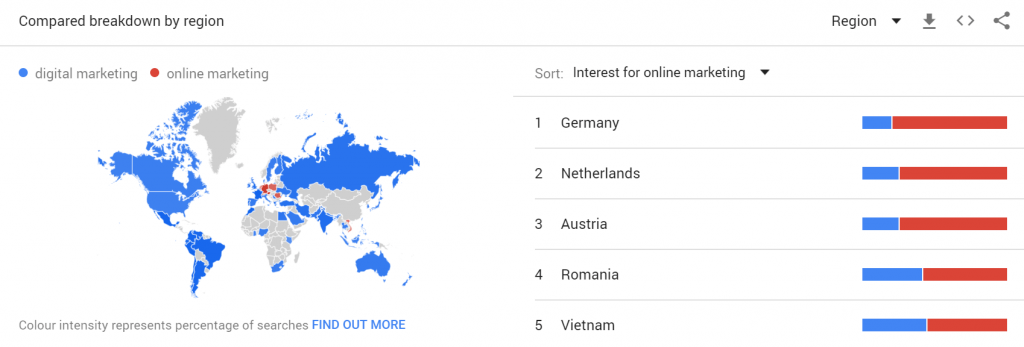

And the search interest over time is not the only thing that Google Trends provides. It’s also a great way to study the market from different regions. In the example we’ve taken, we compared the search interest for digital vs. online marketing. Below you can see which countries search for the words “digital marketing” and which one search for “online marketing”. Now if you look at the screenshots below what can you notice?

The “digital marketing” search phrase ranks really well in countries such as France and Morroco. The users have different search behaviors, that’s what we want to show with this. Mexico, Columbia and Peru look more colored in this screenshot than the one for “online marketing”. Canada and US are also more keen to use “digital marketing”.

On the other side, the “online marketing” has more searches in Germany, Netherlands, Austria, Romania and Vietnam.

This type of small researches can help you take some decisions before considering a digital marketing strategy to promote your business.

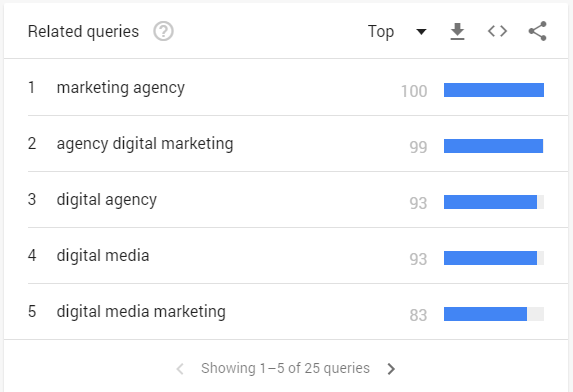

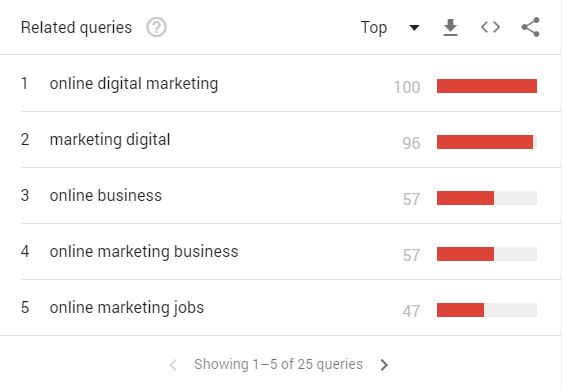

Google Trends even offers some of the Google Keyword Planner tool functions by suggesting related keywords for the one you’ve just entered. You can use it to keep track of the keywords that are gaining ground rapidly (rising) and from those, you can notice some opportunities for your competitive strategy.

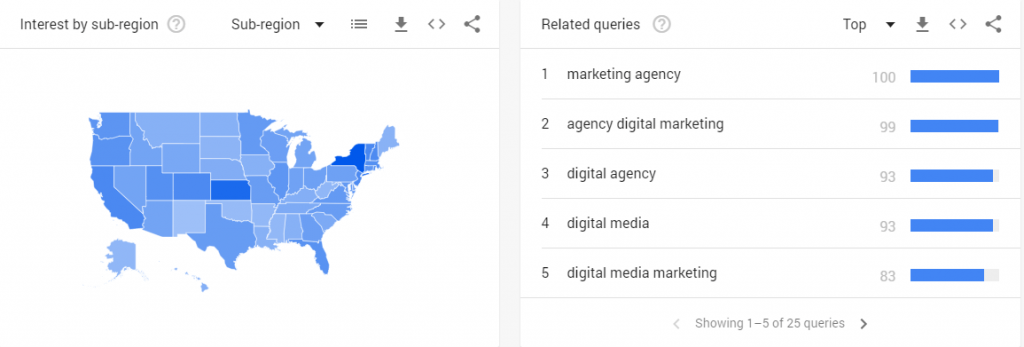

You can even see the relates queries for sub-regions or a specific country, by clicking on the state you want. You even see the data for each city.

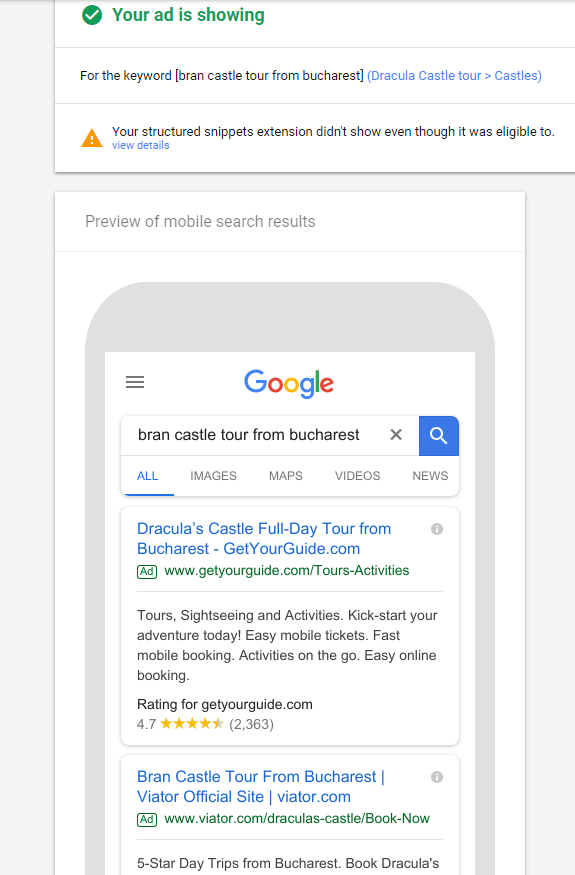

1.3 Google Ad Preview and Diagnosis Tool

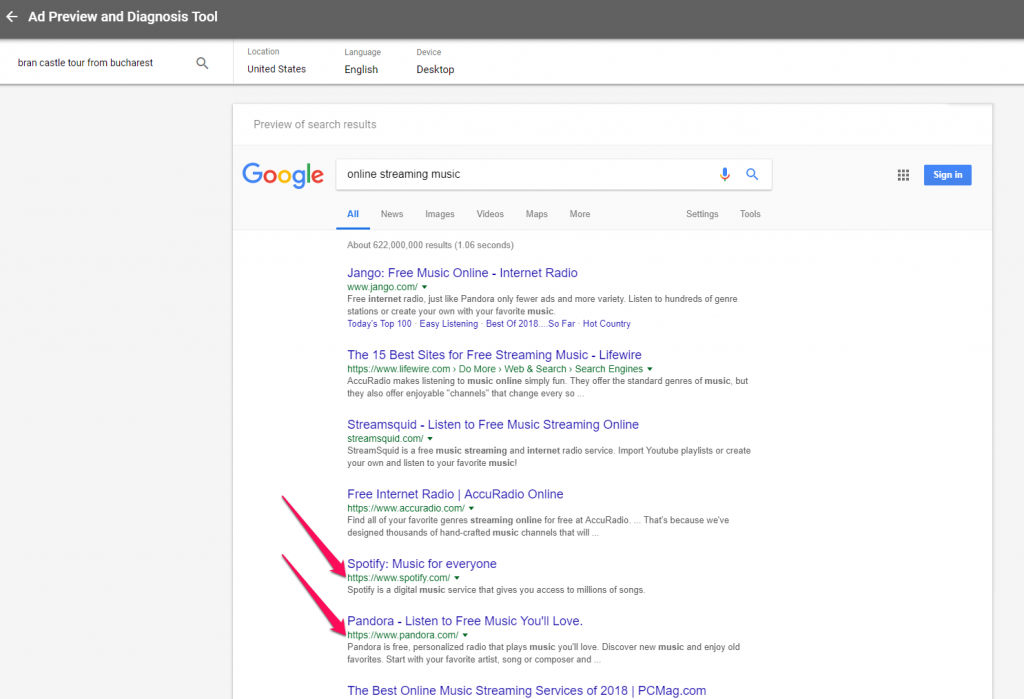

Ad Preview and Diagnosis tool is a great addition to enrich your competitor analysis. In theory, this tool provides you with the position of your competitor’s ad (along with yours, if that’s the case). You can see your top competitors and what keywords (or phrases) they are tracking, what they are promoting. You’ll get a closer step in understanding your competition.

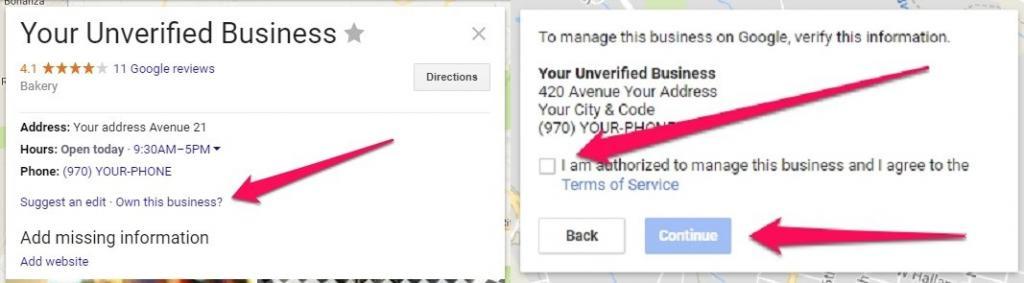

1.4 Google My Business

Google My Business can really push your business on SERP if you setup your account correctly and let your customers know they can leave reviews. The tool is entirely free and it is easy to use. When creating a page, it is recommended to see if the business isn’t already on Maps. If you found it, you have to claim it and edit the info, following the steps from the screenshot below.

In case you don’t find it, you’ll have to create it. Add your business address, type of business, and website. After that, you’ll have to wait for a confirmation (a verification code in a postcard, most probably) which comes through mail, and that can take up to 14 days. Select businesses have the option to verify the business listing by phone or email.

To level up, add high-quality pictures regarding your office and business; add street-view, get reviews for your website, because they will help you rank higher in Map searches. Connect it with the Google + profile to get even more exposure.

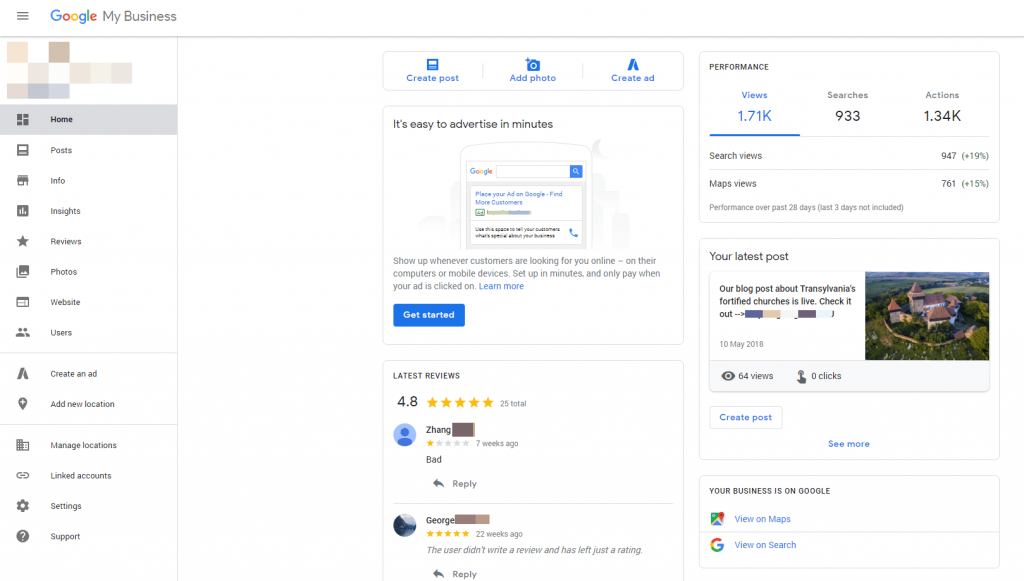

After you finished setting up your Google My Business page, you can edit and perform other changes or see performance metrics directly from the Dashboard:

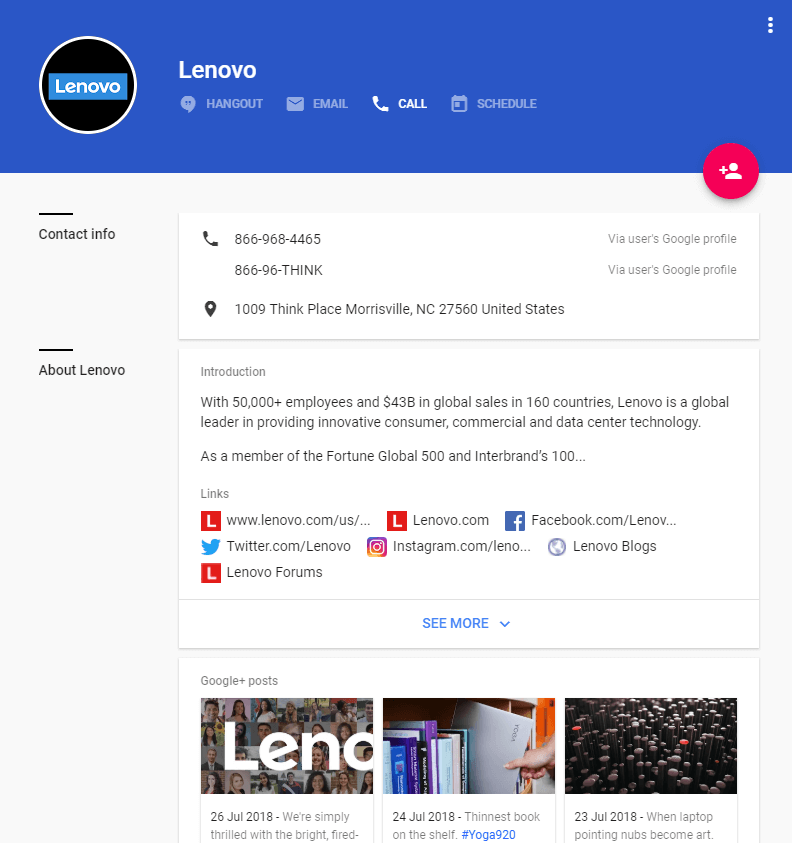

1.5 Google +

Another tool in Google’s arsenal is Google +. I think social media was born to spy and follow what other people are doing without them knowing. It’s acting like the Invisibility Cloak. Google + is a powerful tool because it offers you the possibility to see what your competitor is sharing, if it has an active account, if it is has a verified account, the circles it’s in, the marketing campaigns it runs and many more.

In the example below, you can see Lenovo’s Google + profile. It has a complete profile, integrated with other Google tool such as Hangouts, Google Calendar, Gmail plus links to its other social channels such as blog, Facebook, Instagram.

At a quick scroll on their page, you’ll see posts mostly with inspirational messages and quotes, along with technology pictures mixing with pictures regarding the team and other Lenovo activities, and some Star Wars references. Doing a short analysis of their page help you see which type of content had more traction, get inspiration for your posts to attract the audience and get an overview of your competitor’s online presence.

We’ve witnessed a social signals impact that gets higher and higher as the time passes by. Social Media influences the evolution of a business. We made an in-house research where we analyzed the influence of social signals towards a website’s rankings. It showed that a strong presence on social networks is correlated with better rankings.

1.6. Google Analytics

To complete your market research use Google Analytics. There are some things from Google analytics that can give you an idea of your competition and your industry. The benchmarking option allows you to compare your data with aggregated industry data from other companies who share their data. That means you can get an idea of what happens with those that are in your niche – your competitors. You have to enable benchmarking first:

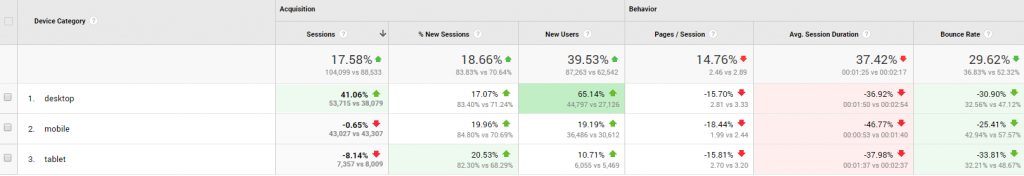

After that, you’ll be able to see data related to devices, location and channels, which can give you a slight idea to see where you should focus more, where your competition is, where you have issues. More than that, you’ll have the opportunity to get some insights on your market segment.

2. Your Market’s Behavior

Now that you’re familiar with the tools and what we are going to use them for, let’s take a real market example and see how we use it. We chose to take the music streaming market to explain an in-depth use of Google’s arsenal. The first thing when trying to enter a market is trying to learn the behavior of the consumers. When researching, we are going to focus on the following:

- What do consumers search for?

- What are the consumers’ expectations?

- How are the competitors taking advantage of the consumers’ search behavior?

- Which are the overall market trends?

- What is the brand power of my competitors?

- Can we find any hidden opportunities?

2.1 Customer Behavior Unlocking

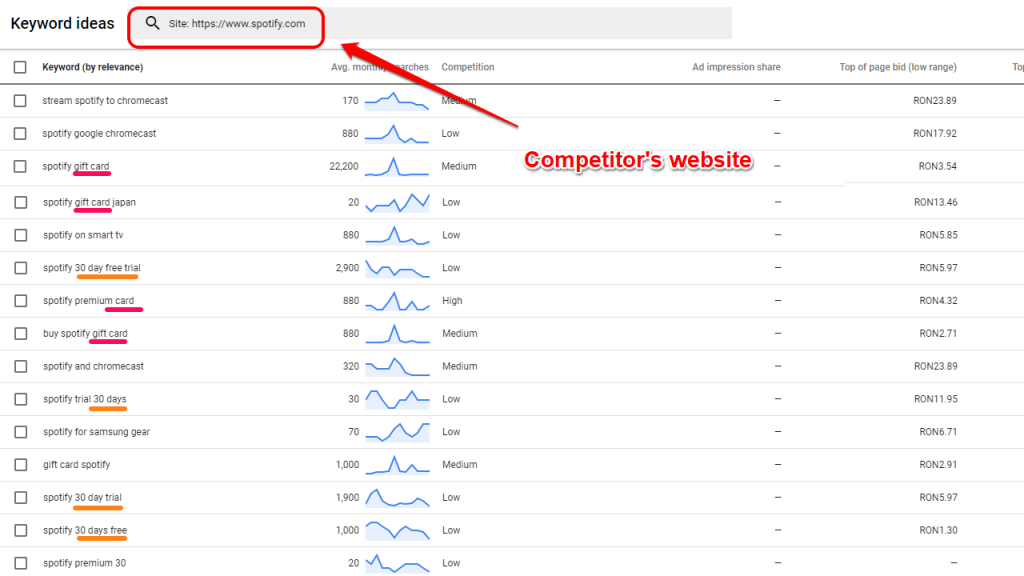

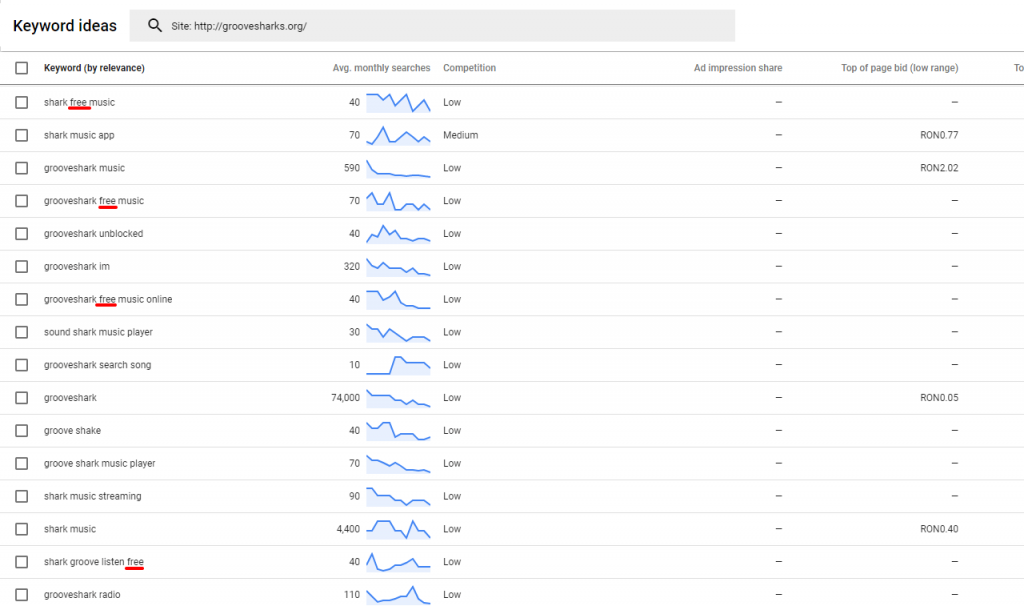

The first tool we go to in our analysis of the music streaming market is the Google Keyword Planner. This tool will answer the first two questions (What are consumers searching for? & What are their expectations?) and maybe give us a hint for the last question (Hidden opportunities). To get to the answers, we inserted the landing pages of our future competitors in the keyword planner and began to read what it provides.

The competitors we considered for our analysis are Spotify, Pandora and Grooveshark. There are plenty more to study in order to make a complete analysis, but for the purpose of presenting how to do a competitive analysis information, we consider this to be sufficient to start with.

Search for your competitor’s website, add filters and removed the noise. All that is left are relevant keywords that the users search for to get to the pages.

By entering the landing page for Spotify, Google Keywords Tools will show some keywords recommendations that might be related and could fit its description.

If we look at the keywords suggested by Google, an overwhelming amount contain the word “gift card” and “30 days trial”.

We can already start to figure out some expectations for the future users of our tool. Potential users don’t want to pay for it, they expect it to be free. Let’s study the other two competitors to see if this behavior fits all the users.

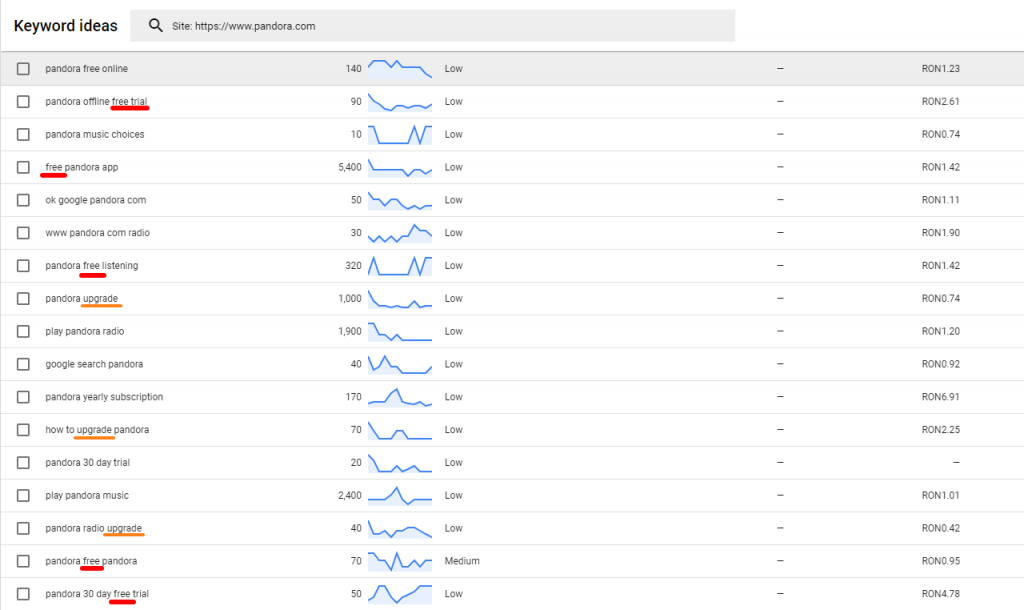

For Pandora, the situation is almost the same. The difference here is that Google also suggests the word “upgrade” and “radio” more often. Their SEO efforts could have focused on promoting the service as an online radio in order to gather more website visitors from Google who search for this kind of service.

We can already start painting the persona for the user who searches for online music streaming.

Let’s check the last competitor to see if our theory is valid.

Grooveshark validates our theory. For online music streaming services, people search for online music, radio and expect it to be free. We still need some more data about the users; the volume of searches per month is the next one.

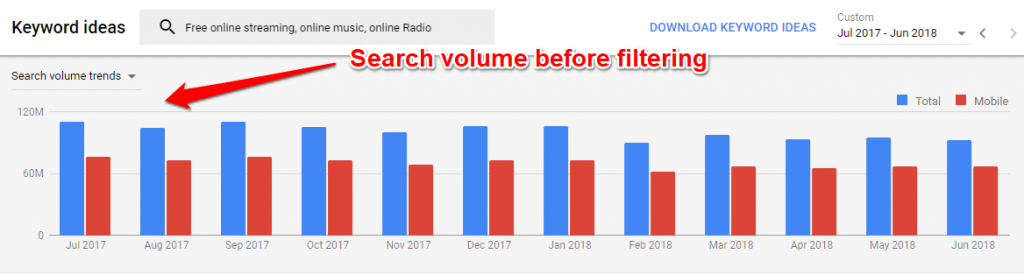

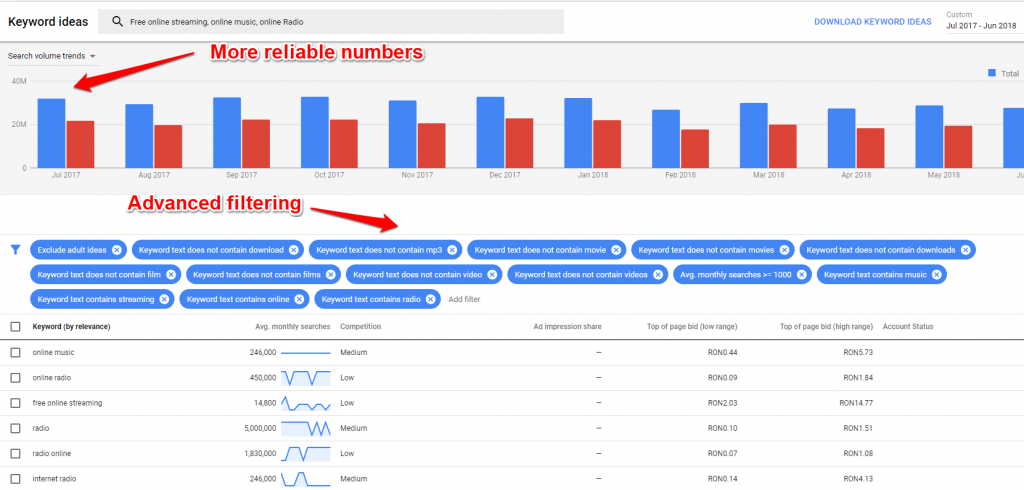

We have some keywords that stand out for each competitor: “Free online streaming”, “online music” and “online Radio”. Let’s study them to find out the potential market.

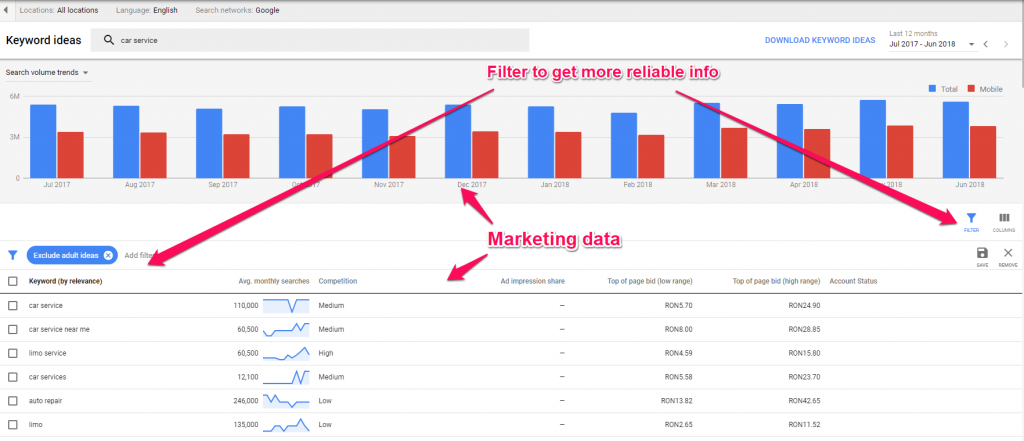

What you see in the chart above could seem too encouraging at first but these results are filled with noise (useless keywords, irrelevant for the music streaming business). Almost 60 million organic searches each month for keywords related to those we placed in the input. Let’s start filtering to get to the reliable numbers.

After we added the filters (average monthly searches > 1000; removed other keywords), we get some real numbers about the volume of searches. The overall number of monthly searches for keywords related to online music streaming is about 200.000. This is encouraging since that could be considered potential website traffic for your new business. The numbers for the exact keywords are a bit low, free online streaming gaining 14k monthly searches, while online music 246k, online radio 450k, and radio online 1,8M searches.

So what do we know until now?

The market has about 40M monthly searches with a potential of over 120M, people are looking for online radio and online music and expect it to be free.

Also to mention is the fact that there is a slight drop in search volume during spring. Let’s see how the other tools can help us build a complete user profile and market trends.

2.2 Where Are Your Customers Looking for Your Business

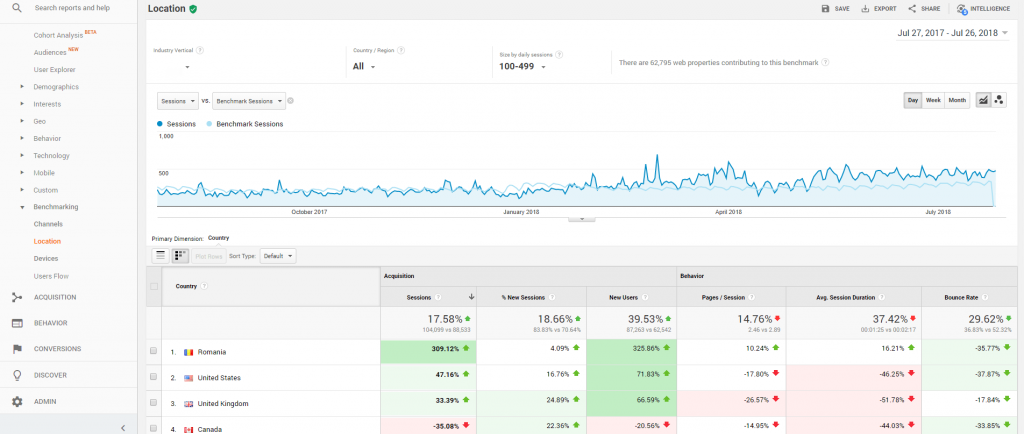

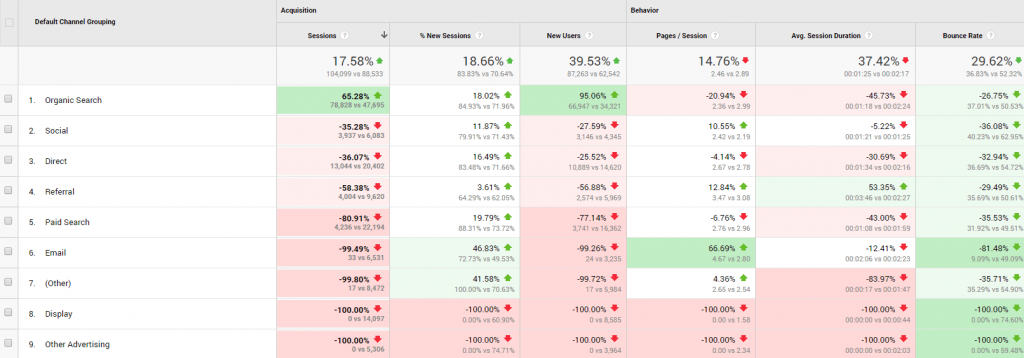

Let’s complete our users’ profile by studying the channels they are using, offered by Benchmarking in Google Analytics.

I know there is a lot of data in that chart, but you should look only to the one that interests you. In our case, look at the sessions column. Using the benchmarking metrics, you can compare your data against benchmarks and make a short market research. For example, the number of organic searches had a beautiful increase of 65.28% compared to the benchmark. The site had 78,828 vs. 47,695 (the number of the organic searches for the benchmarks).

From the chart above we can see the website could improve the metrics for email, display, and other forms of advertising since the competition is there and the audience too.

Another data you could use to see where is the audience looking for your business is the devices info. Since mobile raise so much into the statistical data, is important to offer information that can be easily accessed by mobile.

2.3 What Development Stage Has Your Market Reached

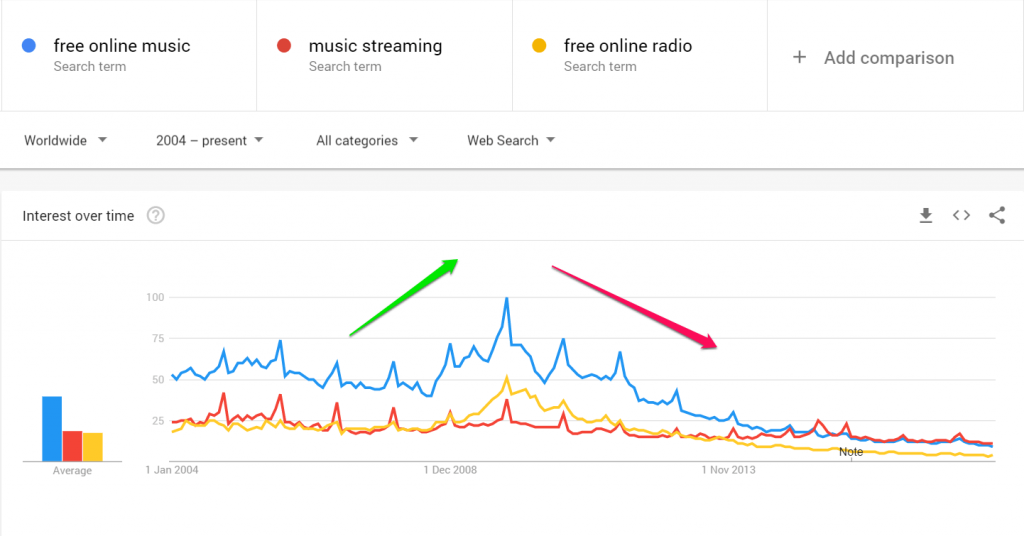

Google Trends is great at studying the stage of the market. We can insert the keywords that we believe to describe a certain market, and by studying the results we may conclude if an industry is gaining traction, if it was or is interesting to the average user. Let’s take a look below:

We can see that the overall trend and the search interest for “free online music”, “music streaming” and “free online radio” is in a downward trend. It peaked somewhere around 2010 and since then the interest has gone down. Now, we have to be extra careful when drawing conclusions here because there could be some errors.

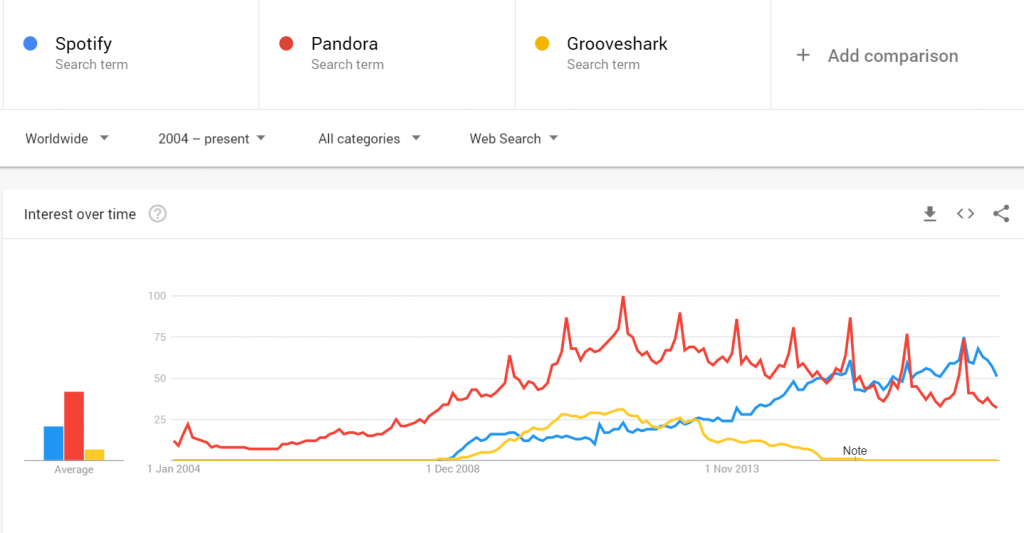

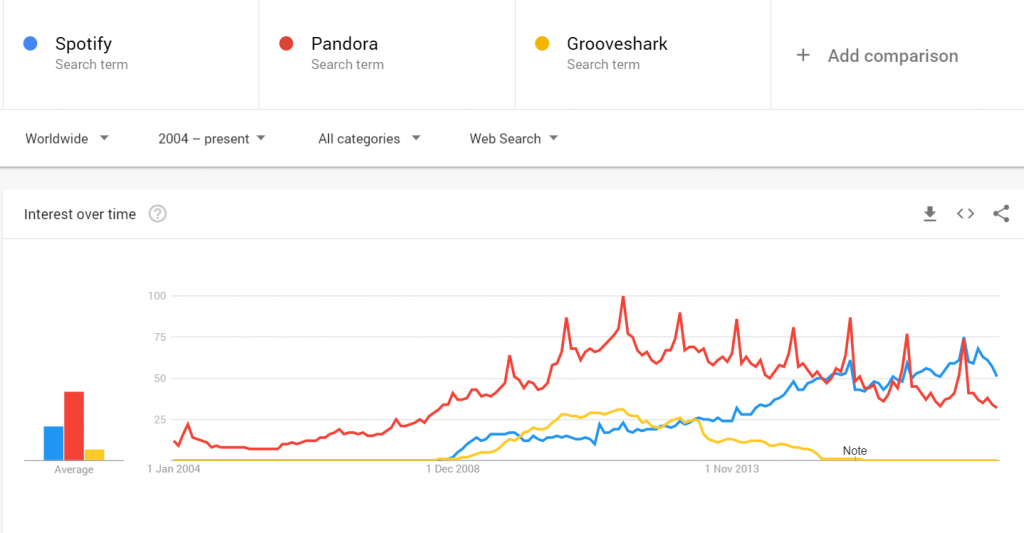

The downward trend could indicate the fact that people just aren’t interested in online music streaming, or it could just as well indicate that the market has matured and that people became loyal to a competitor. We tested this theory and searched the brands we used in our study: Spotify, Pandora, Grooveshark.

It seems like the searches for this brands started to increase around the same time when the previous terms had a drop down.

*Full disclaimer here; while we said in the beginning of the article that Google’s tools aren’t enough to make a complete marketing strategy, we feel that we should mention it again throughout the article. Do use other tools and data for a complete marketing strategy, use Google just as a starting point to get an overall image of the market.

3. Uncovering Your Competitors’ Secrets

From our last chapter we can say that we gathered a lot of data from the market. The fact that the online music streaming industry is maturing, that users have become loyal to certain brands, the personae who want free online music and spend their time on mobile devices are great assets. We can use all this Google data to make a strong marketing strategy and grow your business. Let’s now study the competitors, benchmark them and see their strengths and weaknesses.

Let’s move on with the analysis then, and the first thing to study is “Brand Power”.

3.1 Benchmark Every Metric to Your Competitor and Figure out Your Brand Power

Brand power is the interest in Google Trends over time. We inserted the brand of the three competitors we are studying into Google trends and we got the following result:

From the analysis, we can see that Pandora has the greatest brand power among the competitors. It did have a larger lead in later years but Spotify has gained a lot of ground. Grooveshark’s brand power seems to be going down starting from 2013 and had a definitive fall in 2016.

It’s also worth mentioning that Pandora’s trend could be affected by the launch of the movie Avatar in 2009.

The planet the movie takes place is called Pandora and Google doesn’t differentiate that in the search behavior of users. Though I don’t suspect it made large impact in the overall trend for Pandora, some spikes from the year 2009/2010 could be attributed to the movie. And right here we have our first limitation of the Google Trends tool; if your competitors have common names, we don’t really suggest using Google Trends to study their brand power.

Another reason why it has the largest trend is that another brand has exactly the same brand name: Pandora jewelry, which was founded in 1982, before the music company Pandora, that appeared in 2000.

Even if the brand had a huge spike, somewhere around January – February 2017, Spotify started to outnumber Pandora. Let’s check with the Google Keywords Tool to see if the brand power is similar for January 2017 – January 2018.

Indeed, the number of searches for Spotify is 60% higher than Pandora. With over 16 mil searches each month, we can note that Pandora holds the biggest market share for online music streaming.

3.2 Always Compare Yourself to Your Competitors

This is a constant process for all businesses.

Comparing to competitors is an ongoing activity of the marketing department, or in the case of a small company, the marketing guy. What you need to keep track of here is the brand power. This is one of the most important metrics you can extract from the tools offered by Google.

It’s the way to attach a measurable number to the marketing efforts that are hard to track (content marketing). Seeing each month that the volume of searches is increasing for your brand is in a great part attributed to a great content marketing strategy, and it’s encouraging to see that people are actually searching for your brand and not only for your services.

This makes things so much easier for you to study the market since you can now review the add impressions of different competitors to see exactly who is most successful.

You can even concentrate on keywords with lower competition and suggested bids where you can more easily rank in top ad positions.

3.3 Check Which Competitors Target Certain Keywords

Now that we have the brand power of the competitors, let’s find a glimpse of the keywords targeted by the competitors. It’s a bit of a stretch to call it that, since the Ad Preview and Diagnosis tool shows you what keywords are targeted by the competition, not their complete search engine optimization strategy.

It’s still a great tool to figure out what each landing page is optimized for, and check your competitors’ content. You’ll have to search for the keywords you are targeting and create a list of strengths and weaknesses in terms of ranking keywords for your competitors to gain a competitive advantage. You can identify your competitors for specific keywords. Also, it offers an advantage towards your competition because you can also see the bid for certain keywords and you can use that to create better sales and marketing campaigns.

Once you’ve entered the query, Google will firstly show you the paid results and then the organic search results for the country and device you set. In case of Pandora, Google shows the place of the page in SERP which is outranked by Spotify by one position.

The next step is doing the same analysis for the other two competitors, compiling a list of all the results and trying to optimize your landing page for the same keyword groups.

4. Identify New Market Opportunities

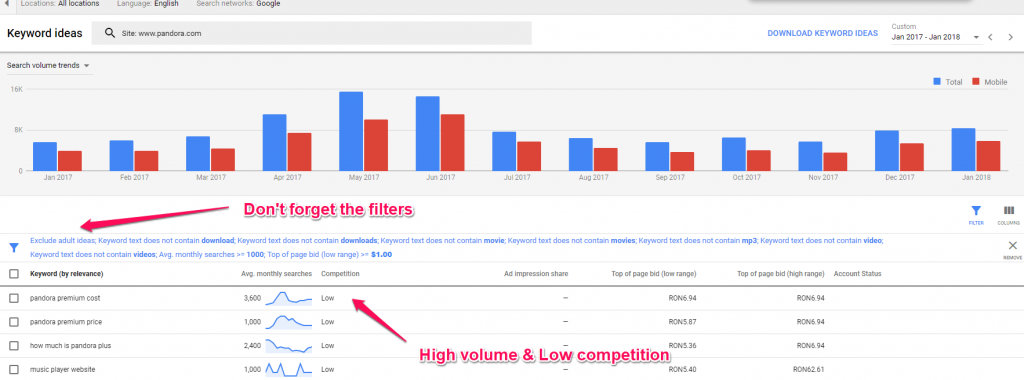

So we went through the market, we looked at each competitor, now it’s time to figure out how to get ahead by finding new keywords that the competitors might not have yet discovered. For this, there are a couple of tricks using the Google Keyword Planner tool. We’ll try to present some ways to target keywords that will generate traction and could bring traffic to your website from various search engines.

4.1 Low Competition High Search Volume

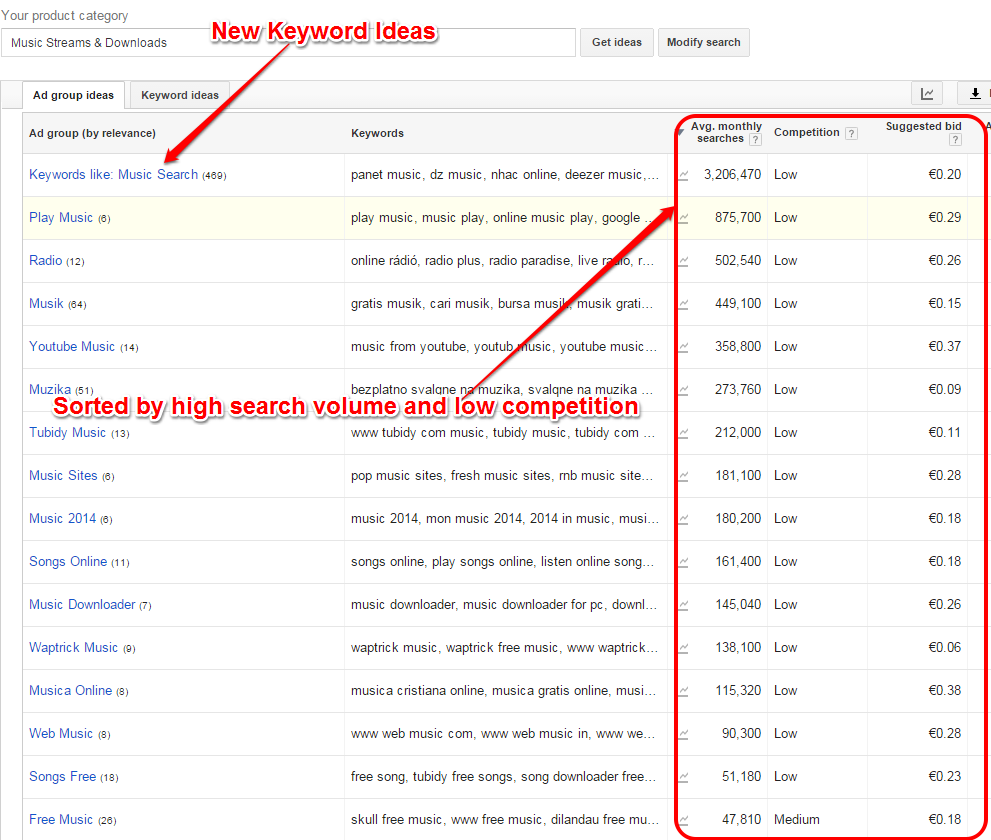

The first trick to get to those juicy keywords starts once again with entering the competitors landing page into the Google Keyword Planner. Google recognizes the website type of Pandora and begins to list out keyword ideas for it.

The following filter types were added:

- Average monthly searches > 1000

- Suggested bid < 1.00$

- Various negative keywords (keywords that were not relevant) to remove the noise: download, downloads, movie, video, mp3

What we’re left with are very relevant keywords for your business that have a high average monthly search and very low bids. This is exactly what you should target with your SEO strategy.

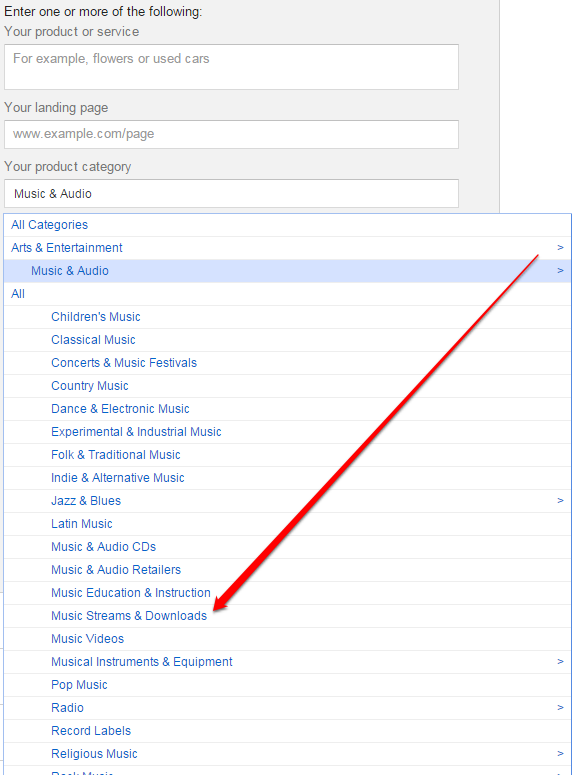

4.2 Seek for Keywords Not yet Targeted

The product category search of Keyword planner is a great way to find “untapped” niches. Just select the product category that your product fits in, or you can select a category similar to yours, that you believe it holds some potential customers and begin the analysis.

We continue with the online music streaming example and select the “Music Streams & Downloads” product category.

This is what you get.

Tons of keyword ideas that you can target with the SEO strategy, be it through content marketing or adwords.

Again, don’t take them all as Google displays it to you, filter the data. Even if it greatly reduces the potential reach and search volume why would you want to spend resources on irrelevant keywords to your business?

Always go for the high search volume keywords with low bid numbers, since your competitors aren’t really tackling them.

Conclusion

Firstly and most importantly, what we want you to gain from this post is that using only Google’s tools to make a competitor analysis is not enough. But it’s a great start, you get tons of relevant information – in such a short time – that allows you to gain a strong competitive advantage. Information that you might not find anywhere else, juicy keywords with Google Keyword Planner, industry trends and market behavior using the Google Trends Tools, constant monitoring of your competitors using Google Ads Keyword Planner and demographic, behavior and influencers data from the Google Analytics Benchmarking that can enrich your business strategy.

The second most important thing we wish you would remember from this article is the fact that the majority of the data needs to be filtered and taken in with a grain of salt. Google offers us both in the Keyword and the Display Planner tools rich filters to get to the information we really need and the one that is relevant to our industry only by enjoying all the features and benefits there are available for free.

How often do you use the Google Tools for business in your competitive analysis?

Site Explorer

Site Explorer Keyword tool

Keyword tool Google Algorithm Changes

Google Algorithm Changes

😉 always learning something new. Google Alerts are great for checking this kind of stuff